An Unfolding Recovery

There are signs that the global outlook has started to brighten, though growth remains modest. The impact of tighter monetary conditions continues, especially in housing and credit markets, but global activity is proving relatively resilient, inflation is falling faster than initially projected and private sector confidence is improving. Supply and demand imbalances in labour markets are easing, with unemployment remaining at or close to record lows. Real incomes have begun to improve as inflation moderates and trade growth has turned positive. Developments continue to diverge across countries, with softer outcomes in many advanced economies, especially in Europe, offset by strong growth in the United States and many emerging market economies.

Global activity has proved surprisingly resilient so far

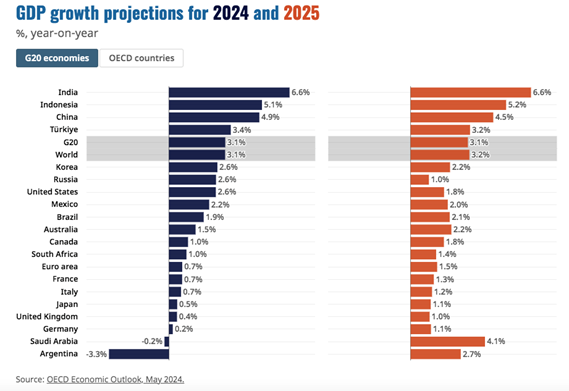

Global growth in 2023 continued at an annual rate above 3%, despite the drag exerted by tighter financial conditions and other adverse factors, including Russia’s war of aggression against Ukraine and the evolving conflict in the Middle East. Global GDP growth is projected at 3.1% in 2024 and 3.2% in 2025, little changed from the 3.1% in 2023. This is weaker than seen in the decade before the global financial crisis, but close to currently estimated potential growth rates in both advanced and emerging market economies.

Inflation has been falling towards targets, but some pressures persist

Headline inflation fell rapidly in most economies during 2023, driven down by restrictive monetary policy settings, lower energy prices and continued easing of supply chain pressures. Food price inflation also came down sharply in most countries, as good harvests for key crops such as wheat and corn saw prices fall rapidly from highs reached after the start of the war in Ukraine. Core goods price inflation has generally fallen steadily, but services price inflation has been stickier, remaining well above pre-pandemic averages in most countries.

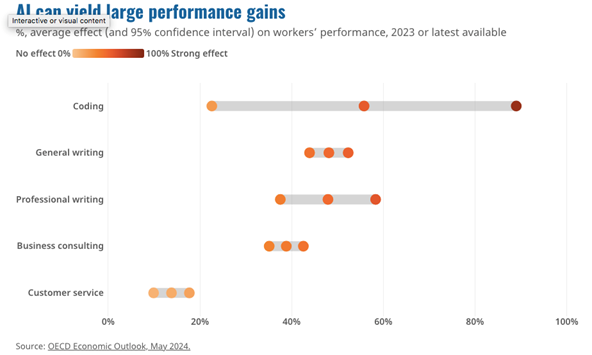

AI has the potential to revive sluggish productivity growth

Artificial intelligence (AI) holds the potential for reviving trend productivity growth and triggering an acceleration of innovation, even if estimates of the impact of AI on productivity are subject to considerable uncertainty. The share of firms making use of AI has risen rapidly, though most of these are large companies. The net effect of AI on aggregate productivity will depend on many factors, including the extent to which new technologies are widely diffused or concentrated in a few leading firms, and the extent to which AI is labour enhancing as opposed to labour replacing.

What should policymakers do ?

- Monetary policy needs to remain prudent, but there will be scope for lowering policy rate

Monetary policy needs to remain prudent to ensure that underlying inflationary pressures are durably contained. Scope exists to start lowering nominal policy rates provided inflation continues to ease, but the policy stance should remain restrictive for some time to come. The pace and scale of policy rate reductions will be date dependent and may vary across countries depending on economic conditions.

- Fiscal policy needs to address mounting pressures to ensure debt sustainability

The ratio of government debt to GDP is projected to rise further in many countries. Governments face mounting fiscal challenges form rising debt service cost and sizeable additional spending pressures from ageing populations, climate change mitigation and adaptation, defense and the need to finance need reforms. Without action, future debt burden will rise significantly. Stronger establishment of credible medium-term spending and tax plans tailored to country-specific developments are necessary.

- More ambition is needed on structural policies to improve growth

Prospects for long-term growth and improvements in living standards appear modest. Stronger policy action is required to boost investment and enhance skills development and intensify innovation, to drive technological progress and productivity growth and boost employment. Innovation is crucial for successful and cost-effective climate transition. While the majority of research efforts are undertaken in the private sector, government policies can and should continue helping foster innovation. Well-designed public support for R&D, both for basic government-funded research as well as through direct grants to business or R&D tax incentives, should aim to complement private investment, with rigorous evaluation of public efforts built into national investment strategies.

Philippe Alezard