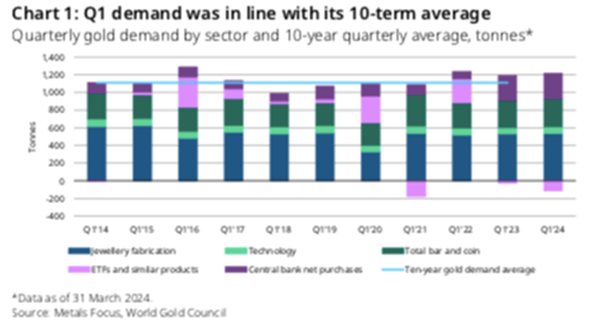

L’once d’or a atteint des plus hauts historiques sur le 1er trimestre 2024 au-delà des 2,200.00 USD. L’or est toujours un « actif » refuge lors des périodes de tensions géopolitiques et l’actualité est malheureusement riche en ce domaine.

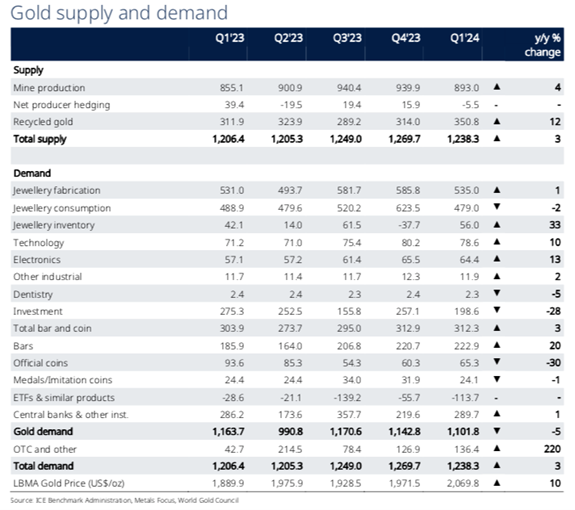

Mais comme le souligne l’étude du World Gold Council la demande d’or est très soutenue. Sur le trimestre en cours c’est plus de 1,200 tonnes qui ont été produites, quasiment 900 tonnes par les mines et plus de 350 tonnes recyclées.

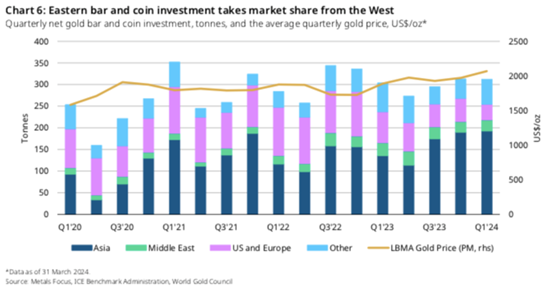

La bijouterie reste le premier consommateur d’or, suivi de la demande des investisseurs « grand publics » d’achat de lingots et pièces d’or. Les banques centrales sont toujours à l’achat même si on constate un léger repli, sauf en Asie et Middle East, les banques centrales chinoises et turques restant les premiers acheteurs.

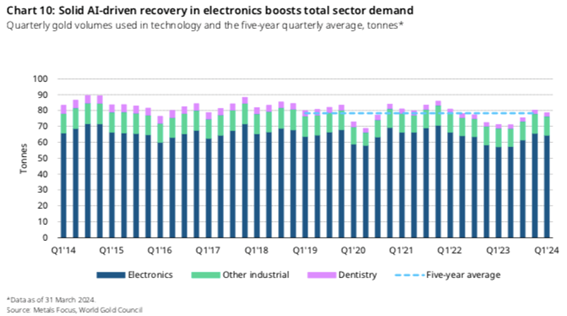

On notera que la demande de métal précieux pour le secteur industriel est toujours en croissance également.

Au total seule la demande d’ETF sur l’Europe et les Etats-Unis reste en retrait.

Ph Alezard

Central banks and OTC drove the price

Q1 gold demand (excluding OTC demand) slipped 5% y/y to 1,102t, due to continued ETF outflows. Inclusive of sizable OTC buying by investors, total gold demand increased 3% y/y to 1,238t – the strongest first quarter since 2016.

Q1 saw no let-up in the pace of central bank gold buying: 290t (net) was added to official holdings, only part of which is currently reflected in IMF data.

Bar and coin demand matched the previous quarter at 312t, translating to a 3% y/y increase.

Global gold ETF holdings fell by 114t. Europe and North America both saw quarterly outflows, slightly countered by inflows into Asian-listed products. US- listed funds saw a positive shift late in the quarter.

The jewellery sector was healthy, given the price rally. Global jewellery consumption was just 2% lower y/y at 479t. Jewellery fabrication grew by 1% y/y to 535, resulting in inventory build of 56t during the quarter.

Technology demand for gold recovered 10% y/y as the AI boom boosted demand in the electronics sector.

Central banks and retail investment provide the platform for a strong 2024.

- 2024 is set to produce a much stronger return for gold than we anticipated in our 2024 Gold Outlook, supported by continued EM central bank buying and retail investment even with the continued absence of visible physical Western investment

- The stellar run up in price in the recent weeks will likely prompt a rise in recycling supply and a fall in jewellery demand, although elevated geopolitical risk and the quasi-investment role of jewellery in some countries may limit the impact

- Mine supply is set to break new records on expansions in North America and low levels of hedging, as producer margins hover near record highs.

Having made successive record highs throughout March and into April, the gold price has witnessed a correction in recent days,ahealthy development in ourview. Any levelling off in the gold price in the months ahead should encourage some price sensitive buyers back into the market. Upside potential remains in the gold ETF space as the shift out of gold and into positive yielding bonds in Europe could run its course with ECB rate cuts looming. North American ETF investors banking on Fed rate cuts may have to wait a little longer: a no-landing economic outcome is growing in popularity, suggesting rates will stay quite high. But US economic strength remains somewhat superficial, helped by the long and variable lags of interest rate policy, the full impact of which may not be felt until later in the year. As such, US investors may need to wait for a clear signal to trigger ETF inflows.

Investment

Bar and coin demand is set to remain strong. China is largely responsible, having started the year with the strongest quarter since 2017. With improving household wallets, the positive example set by continued central bank demand, a poor domestic equity, and property market and currency fragility, the conditions are in place for demand to continue at solid levels. Indian bar and coin demand has been lagging model-suggested levels based on economic growth. It is expected to be higher than last year, helped by an expectation for a better monsoon and solid economic

ETF demand remains notable by its absence, particularly in Europe – where, anecdotally, institutions refusing to hold negative yielding bonds shifted into gold a few years ago. It seems likely that the past year (and more) has seen a cashing out of gold back into positive yielding bonds, and this might become harder to sustain if and when policy rates are cut. The US has shown a glimmer of hope during April, but rate cuts might be needed to help trigger sustained inflows. Sticky inflation and labour market strength suggest there will be a bit of a wait.

Elsewhere, Chinese funds continue to attract inflows at a solid clip having seen 29t of inflows in the four weeks to 19 April versus 36t of outflows from Europe and neutral US flows over the same period.

Fabrication

Perhaps the most surprising feature of Q1 was the resilience of jewellery demand in the face of much higher prices. The price strength, however, came towards the end of the quarter, and is likely to feed through to some demand weakness in Q2.

China’s jewellery demand is expected to remain stable to slightly higher compared to 2023, on rising incomes and stable prices during the rest of 2024. Indian jewellery demand will continue to draw support from the strong economy, but high gold prices, and some election-related weakness are likely to weigh on demand.

Technology demand is set to produce some solid growth, particularly in the chip and automotive segments.

Central banks

Although a whisker away from a new record and comfortably beating our initial – tempered – 2023 forecast, we remain cautious as we look ahead. The multi-year trend of net central bank buying appears established, but there may well be some central banks willing to wait on the sidelines in response to the recent price surge. Equally, opportunistic sellers may be more likely to get drawn out with the stellar rise in prices so far this year.

The March slowdown in monthly reported buying could signal some reticence by reserve managers to accumulate at these levels, despite unreported buying showing no such restraint. A lack of sales was also notable in Q1, but given the late quarter price run-up, Q2 might reflect what Q1 did not; as is likely the case in other demand categories.

Supply

Mine supply is expected to beat the previous record high in 2018 on expansions and ramp-ups.

Around two-thirds of this growth is likely to come from Canada, China and Ghana. A mild Northern Hemisphere winter has helped Q1 off to a good start, but a sizeable swing in hedging makes the y/y comparison weaker for total mine supply.

With spot prices expected to stay not only high but above the 90th percentile of the cost curve, marginal producers will be incentivised to continue strong production schedules. AISC margins have almost exceeded their 2020 peak.

Hedging is expected to be small but positive – although some debt financing nearing an end resulted in net de- hedging for Q1. There is still some incentive from a price perspective, to lock in production at these levels and also given the strong forward contango.

Should prices stay high in 2024, models suggest recycling should pick up, as it started to do in Q1 in response to the rapid price rise. Volumes may, however, be constrained by both geopolitically driven concerns and low near-market stocks, particularly in countries like Thailand. And should prices settle, recycling will likely moderate in response.